Market Review for London & St. Thomas for 2020

Wednesday Jan 20th, 2021

2020 Sales Results in London St. Thomas

CITY OF LONDON OVERVIEW:

Well, it is time to say goodbye to an incredibly challenging and interesting year of changes in our lives and in our housing market, a market driven by changes to lifestyle because of Covid-19. Highest case counts embrace the city of Toronto. Business Lockdowns have established a large “Work from Home” base across the province. Technologies such as computer video cameras and cell phone video cameras, zoom meetings, etc. have made it possible for families to make the move from the Greater Toronto Market a less expensive market such as our market. The average price of 3-bedroom 1950’s bungalow in Toronto can exceed $900,000. Just imagine what $900,000 less your existing mortgage could do to your lifestyle.

Realtors from Toronto are bringing in their clients here with no knowledge or access to recent sales and house values. A Builder has advised that Toronto Realtors are offering full price “sight unseen” to try and lock up a good deal. Another strategy is to place 3 aggressive price offerings with only one condition such as “Conditional on Inspection”. The Buyer can take their time choosing carefully and walk away on 2 of the three homes with their deposit back in hand.

The extremely limited number of active listing is driving up prices dramatically. For example, the number of active listings in December, the slowest month of the year for housing sales, fell by 56.3% from 625 home listed across the City in 2019 to only 275 homes listed in 2020. Virtually every home listed for sale sold!

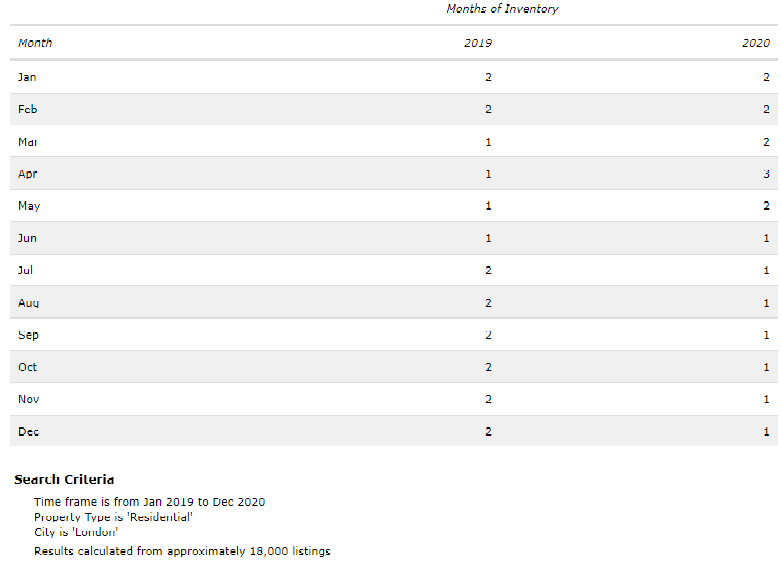

As a result, prices for the month averaged $557,957 up from $442,419 in 2019. The limited number of homes offered for sale is a major contributing factor to driving up prices. You can see by the numbers below what has been happening to inventory of homes offered for sale since the pandemic started.

So, what has happened across the city in December with all this still going on? Sales increased over December by whopping 27.9%. Looking at the full year ending December 31, 2020 the number of homes that sold increased by only 4%, based on limited inventory, to 6,960 homes.

The average selling price of a home situated in the city of London has risen to $494,211 for the 12 months ending December 31, 2020. The average price for 2019 sat at $413,149. This represents a 19.6% increase in one year or +$81,062 in equity for the average homeowner.

We believe we will see a further 10% increase in the average price of a home across the City of London by mid-2021. This will be driven by the continuing exodus of Families from the Greater Toronto area. When Toronto sales slow, things will return to some normality. There exists today in our market a huge pent-up demand by First Time Buyers and Move-Up Buyers all without deep financial pockets to participate in bidding wars well above asking prices.

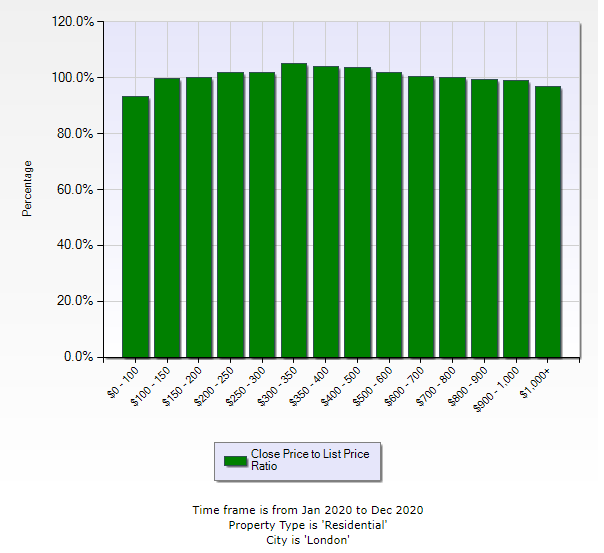

The homes offered for sale between $300,000 and $500,000 all averaged above 103.5% of asking in 2020. Here is what happened in London based on “List Price to Selling Price” ratios by price category. As you can see virtually all price categories sold over asking and benefitted from Price Wars at time of purchase.

London North:

Let us look at December first to illustrate the pressure on prices in this area as well, with fewer homes offered for sale. The number of homes available dropped by 66.8%, to under a month’s supply. The number of homes that sold in December 2020, increased by 41.8% above 2019 levels to 122 sales. The average home price in London North reached a new high for the month to $676,032.

For the Calendar year 2020, sales increased by 4.4% to 2199 homes sold in North London. The average selling price for the same period rose 16.9% or $83,177 to $575,157 from $491,980 a year earlier. As you can see by the month of December Results, prices hitting $676,032 for the month, the price gains will continue for some time yet. $600,000 will buy you some of the nicest homes in London compared to an average house in Toronto for +$900,000. Remember our average price across the city is only $494,211. Until the gap between Metro Toronto and London narrows, or life returns to normal and significantly more listing come to market, this will price rise will continue.

London South:

Once again, we are going to look at December first. Last month, due to a limited supply of homes offered for sale, it took only an average 23 days to sell a home in South London. Despite low availability, sales increased by 23.2% to 133 homes sold for the month. The average price in December hit $570,762.

During the 2020 calendar year, the number of homes offered for sale has constantly been under pressure. From July to December the average months of supply based on sales has sat only at one month. This means virtually every home listed for sale, sold! Despite this limitation, the number of homes sold in 2020 increased 3.9% above 2019. The average price for the year rose a whopping 21.4%, outpacing the North, giving homeowners $89,124 more equity in their home, the average selling price in South London increased to an average of $505,781 for 2020. You can see by what happened in December at $570,762 the upward trend will continue.

LONDON EAST:

We will start with December results to emphasize the upward pressure that our low inventories of available homes are causing. It took only 17 days to sell the average home in East London. Despite this low availability, sales increased by 22.4% to 131 homes sold for the month. The average price in December hit $434,094

For the last two years virtually, every home listed for sale in East London, sold. This means that if there were more homes offered for sale they would sell as well. The number of homes that sold during the calendar year, because of continuing low inventory compared to demand, rose only 1.9% above 2019. Because of this the average price of a home in East London rode 20.8% or $67,046. This brought the average price of a home in 2020 to $389,925 compared to $322,879 in 2019. The upward price trend is continuing. East London will continue to outpace both the South and the North in percentage price gains in the year ahead.

ST. THOMAS:

Its worth looking at December again for St. Thomas. Offering the lowest average price for our area, sales are through the roof. Demand significantly outpaces supply of homes for sale here. The average home listed for sale in December sold in only 14 days. Despite no real inventory of homes available, sales in December hit 52 homes sold or 62.5% more that December 2019. The average selling price hit a record $438,898 for the month.

This city just like the East London area has had an average of only a month’s worth of sales of homes available for buyers for the last two years. Because of this limited inventory, sales were relatively flat at 771 homes sold in 2020 compared to 766 homes sold in 2019. The average selling price for this area rose 17.5% or $60,780, year over year from 2019 to 2020. The average price for the 2020 calendar year reached over the $400,000 mark hitting $407,373. This market like London East will outperform South and North London because of its continued price advantage and limited number of homes available for sale.

SUMMARY:

Once again it is important to look at opportunities for Buyers and Sellers.

FIRST TIME HOME BUYERS

Be prepared to pay 10% over asking. Typically, a bank won’t fund an offer above asking price as part of a mortgage. A home listed at $400,000 selling above this asking price will require the Buyer to come up with the additional down payment. Banks typically only value at listing prices when they appraise. If you are planning to put down 5% to 10% it is unlikely you can finance the property. Home sales are averaging 10% over asking in this price range, which means you will need more than 15% down. 10% going to bring the price to listing price and a 5% down payment against the mortgage. The only real option is to borrow the money from a family member and pay it back by refinancing the home once the price moves above the selling price.

CHANGE BUYERS:

Talk to your bank about Bridge Financing before you start the process. Once you have identified what you are looking for (We set you up to receive all listings that meet your criteria the day that they are listed), you list and sell your existing home with a 60-day or 90-day closing. Then immediately get out and find the home that meets most of your needs, using your equity you should be able to bid 10% above the asking price of the home you want.

Change Buyers a Reason to Move:

Your home is no longer a good fit! You may have outgrown your current home and need something bigger, maybe with an additional bedroom. You have got an eye on a different neighbourhood. Have you ever driven through an area and thought, “I’d love to live here”? You may think that it is out-of-reach for you at this time. Is it? You never know until you work the numbers. You might, in fact, qualify for a home in that area today!

You want to be closer to something! You would love to live closer to work, family, family activities, the country, new school, etc. Moving to a home that is near to one of those “wishes” can have a positive impact on your lifestyle.

It is time for a change! Sometimes a homeowner just wants a change: new surroundings, a fresh start. Who says you need a “practical” reason to sell? If you are looking to get into a new home just because you feel like it, that is your choice. In fact, that may be the best reason of all to sell. You may simply want to move.

NEED TO SELL:

Do not fall behind on your mortgage payments. Wait as long a possible to list and sell. This way you are taking the best advantage of a rising market.

DON’T NEED TO SELL:

The rising of prices is long from being over. Wait, if possible, or until market returns to some semblance of normal inventories of homes being offered for sale (6 Months’ supply) based on demand for them.

Don’t Need to Sell Reason for Move:

You may want to downsize into something smaller – and cash in some of the home equity you have built up.

We are here to help, whenever you, a loved one, a friend, a co-worker can use our 19 years of Real Estate sales expertise to make dreams a realty. Call us at 519-535-3975

Post a comment