February 2022 Sales Overview for London Ontario

Thursday Mar 24th, 2022

This is your overview for February for our city. Sales in both January and February virtually matched the sales for the same period a year ago. 401 Homes changed hands in January and 594 homes changed hands in February.

The time it takes to sell the average home across the city has been trending downward since November and December last year where it sat at 11 days. Jn January this timeframe dropped to 10 days in January then down to 9 days in February. This change is driven by continued low inventories of home available for purchase across the city. Inventories of available homes has consistently remained below what is needed to satisfy the demand by Purchasers during a single month. Technically they are about half of what is needed in a single month.

As a result, Bidding Wars are still rampant. The average homeowner is in a bidding war. The variance to asking price has risen from +11.6% above asking prices in November to 13% over asking prices in December and up again in January to a whopping 21.6% over asking prices, finishing February at 24.6% above asking prices.

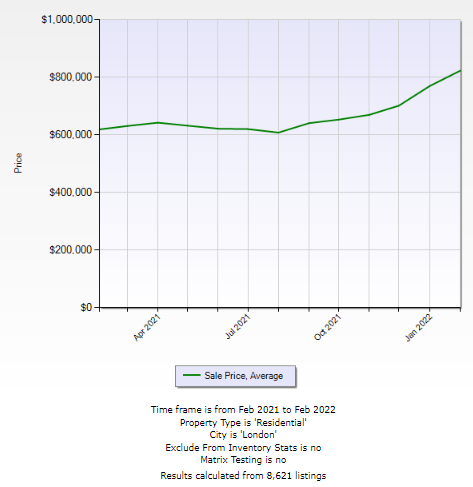

This of course pushes up selling price month by month. So what has been going on month by month?

Averages prices are as follows:

November $670,328

December $702,257

January $775,104

February $823,635

As a result, the average selling price for 2021 finished at $636,685 for the 12-month period. For the first 2 months of 2022 the average price has reached $802,061.

Summary:

So, what’s going on in March? The Federal Government is raising the rates that Banks can borrow at by ¼%. This will result in an increase in mortgage rates. This will require all pre-approved Buyer to re approach their lender of choice to establish a new Pre-Approval. There is a lot of misinformation out there, including rumours of a market adjustment, I will get into more detail about this in my detailed analysis at the end of the first quarter. We should as a result see a downturn in sales in March. I am predicting this will result in about a 25% drop in sales over March 2021. Logic dictates that this drop in demand will have little effect on prices as inventories remain critically low.

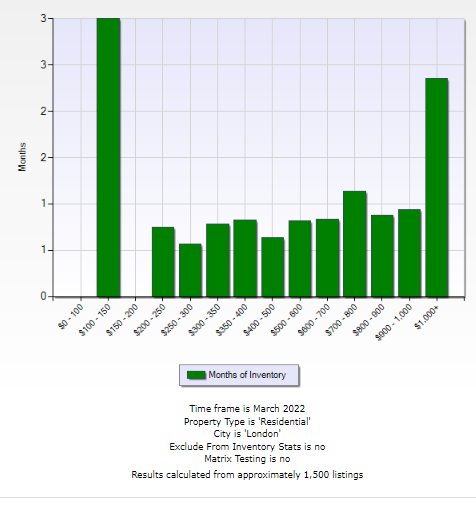

Negotiations in prices occur when inventories reach 6 months supply. Below is a graph of months’ of inventory in the City of London for the first 24 days of March. This would indicate Bidding wars are still ramid in all price categories.

Prices cannot do anything else but continue to rise as long as rental accommodations remain in short supply and investors remain in the market buying homes.

You know someone who could benefit from my assistance with a purchase or sale of a property please call and I will immediately go to work on their behalf.

Gib Heggtveit

Real Estate Broker

Direct: 519-535-3975

Email: gib@yourfavouritertealtors.com

Website: https://www.YourLondonRealtor.com

Post a comment